does indiana have a inheritance tax

It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM. However be sure you remember to file the following.

What Should I Do With My Inheritance Inside Indiana Business

Therefore no inheritance tax returns must be filed at this time.

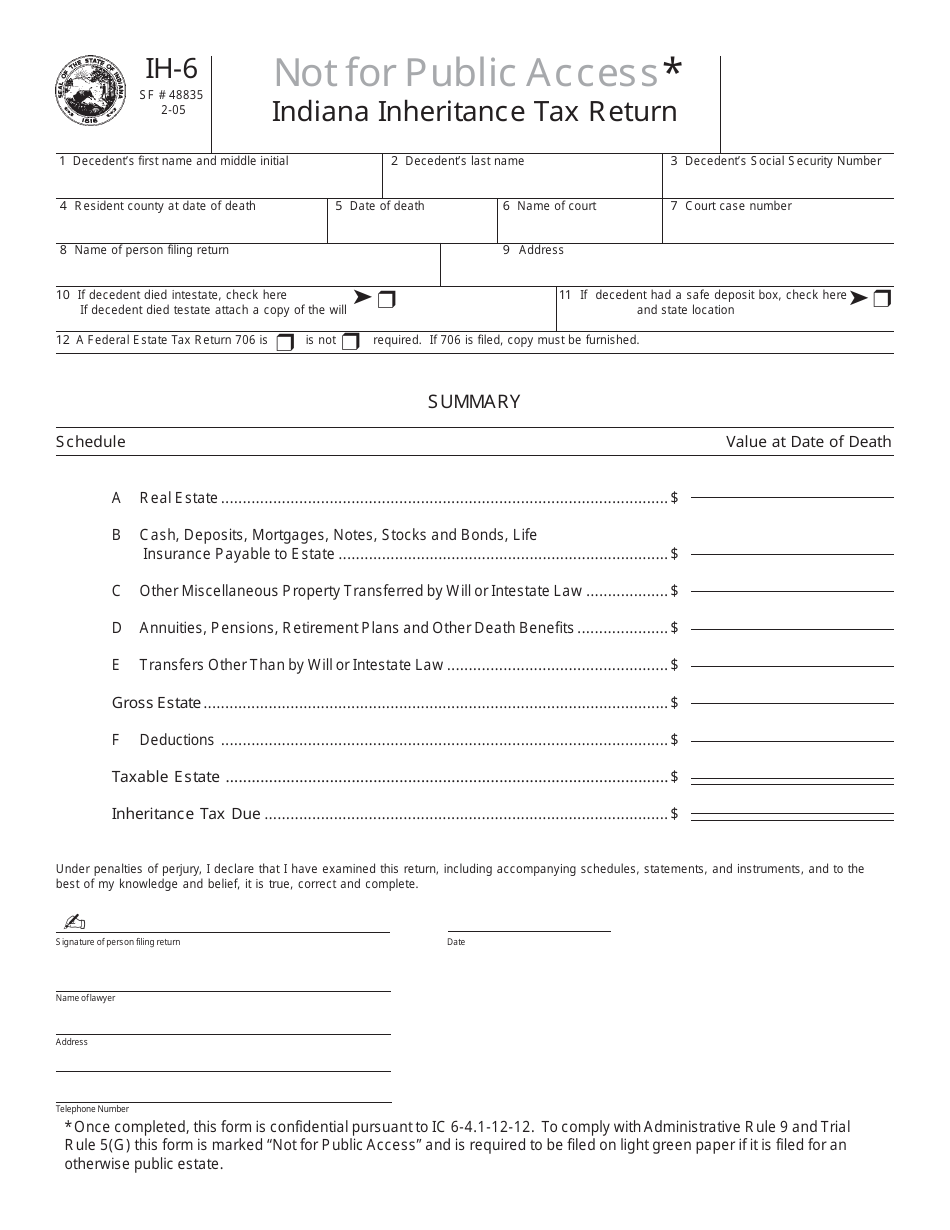

. It would be a good idea to consult a probate attorney in indiana. Are required to file an inheritance tax return Form IH-6 with the appropriate probate court if the value of transfers to any beneficiary is greater than the exemption allowed for that beneficiary. Payment made more than 12 months after the date of death will bear interest at 10 per annum from the date of death.

If payment is made within 9 months of the decedents death a 5 discount will be issued on the inheritance tax due. In fact the Indiana inheritance tax was retroactively repealed as of January 1st of 2013. Here in Indiana we did have an inheritance tax and this is why some people assume that we are one of these states.

For individuals dying before january 1 2013. Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. Details on the Indiana probate and estate tax laws are outline in the table below.

For individuals dying before January 1 2013. Indiana Inheritance and Gift Tax. Thus there is no indiana inheritance tax for those who die after december 31 2012.

There is no inheritance tax in Indiana either. Although some indiana residents will have to pay federal estate taxes indiana does not have its own inheritance or estate taxes. Even though Indiana does not collect an inheritance tax however you could end up paying inheritance tax to another state.

Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent. You can use the advance for anything you need and we take all the risk. This form is prescribed under Ind.

Although some Indiana residents will have to pay federal estate taxes Indiana does not have its own inheritance or estate taxes. Does Indiana Have an Inheritance Tax or Estate Tax. The tax rate is based on the relationship of the inheritor to the deceased person.

Indiana repealed the inheritance tax in 2013. Of course Indiana cannot change federal law and there does remain in existence a. Keep in mind that state laws regarding inheritance taxes can change at any time however so its best to check the most updated tax regulations in your state.

An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. In general estates or beneficiaries of Indiana residents are required to file an inheritance tax return Form IH-6 if the value of transfers to any beneficiary is greater than the exemption allowed for that beneficiary. Although the State of Indiana did once impose an inheritance tax the tax was repealed for deaths that occurred after 2012.

Indianas inheritance tax still applies. States have typically thought of these taxes as a way to increase their revenues. However you may need to pay income tax capital gains tax and wealth tax on your inheritance.

Indiana repealed the estate or inheritance tax for all those who die after December 31 2012. Contact an Indianapolis Estate Planning Attorney For more information please join us for an upcoming FREE seminar. It would be a good idea to consult a probate attorney in indiana.

Does Indiana Have An Inheritance Tax. For those individuals dying before Jan. If youre a beneficiary who lives in one of these states but the deceased did not inheritance tax doesnt apply as of 2021 taxation depends on the deceaseds state of residence not yours.

In general estates or beneficiaries of. Below we detail how the estate of Indiana will handle your estate if theres a valid will as well as who is entitled to your property if you have an invalid will or none at all. Use of Affidavit of No Inheritance Tax Due This form does not need to be completed for those individuals dying after Dec.

India doesnt have inheritance tax. If your probate case does not pay then you owe us nothing. In Pennsylvania for instance there is an inheritance tax that applies to out-of-state inheritors.

Indiana does not have an inheritance tax nor does it have a gift tax. Final individual federal and state income tax returns each due by tax day of the year following the individuals death. Indiana Inheritance Tax should be paid to the county treasurers office which will issue a receipt of payment.

Does indiana have a inheritance tax. Indianas inheritance tax is imposed on certain people who inherit money from someone who was an Indiana resident or owned property real estate or other tangible property in the state. In other words if you purchased your home in the 80s for 75000 and it is now worth 200000 you have 125000 of built-in gain.

The decedents surviving spouse pays no inheritance tax due to an unlimited marital deduction. In general estates or beneficiaries of Indiana residents are required to file an inheritance tax return Form IH-6 if the value of transfers to any beneficiary is greater than the exemption allowed for that beneficiary. The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is 26 20 federal.

It may be used to state that no inheritance tax is due as. If you inherited an immovable property youll also need to pay property taxes. There is no obligation.

However the recipient of assets is subject to wealth tax. This is not a loan as we are paid directly out of the estate and the remainder of your inheritance goes straight to you. That tax has now been completely eliminated and in fact the Inheritance Tax Division of the Indiana Department of Revenue remains open only to enforce collection of tax owed from prior years.

Your credit history does not matter and there are no hidden fees. You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31 2012. 1 2013 this form may need to be completed.

However many states realize that citizens can avoid these taxes by simply moving to another state. However other states inheritance laws may apply to you if someone living in a state with an inheritance tax leaves you money or property.

Wealth Transfer Strategy Give The House To The Kids Inside Indiana Business

Indiana Estate Tax Everything You Need To Know Smartasset

Download Instruction For Ih 6 Indiana Inheritance Tax Return Pdf Templateroller

Avoid These 15 States In Retirement If You Want To Keep Your Money Retirement New England States States

Create A Living Trust In Indiana Legalzoom Com

Indiana Inheritance Laws What You Should Know Smartasset

Chart Of The Indiana Inheritance Tax Law 1915 Library Of Congress

Indiana Estate Tax Everything You Need To Know Smartasset

Indiana State Taxes For 2022 Tax Season Forbes Advisor

Free North Carolina Last Will And Testament Templates Pdf Docx Formswift Will And Testament Last Will And Testament Personal Financial Statement

Indiana Estate Tax Everything You Need To Know Smartasset

Henry S Indiana Probate Law And Practice Lexisnexis Store

Complete Guide To Probate In Indiana

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Historical Indiana Tax Policy Information Ballotpedia

What Happens If You Die Without A Will In Indiana

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller